Kern County Sheriff’s Office Seizes 10 Million Marijuana Plants In 11 Hemp Fields Anyone conducting business in cannabis surely knows that under Federal law (Controlled Substances Act 21 U.S.C. 801) marijuana is designated as a Schedule I controlled substance due to...

Marijuana Tax Planning & Marijuana Tax Defense

What To Look For In Hiring A Cannabis Tax Lawyer

What To Look For In Hiring A Cannabis Tax Lawyer With the legalization of medical and recreational cannabis in California there has been an increase in inquires to our office by people who are just entering into the cannabis market place or looking to provide services...

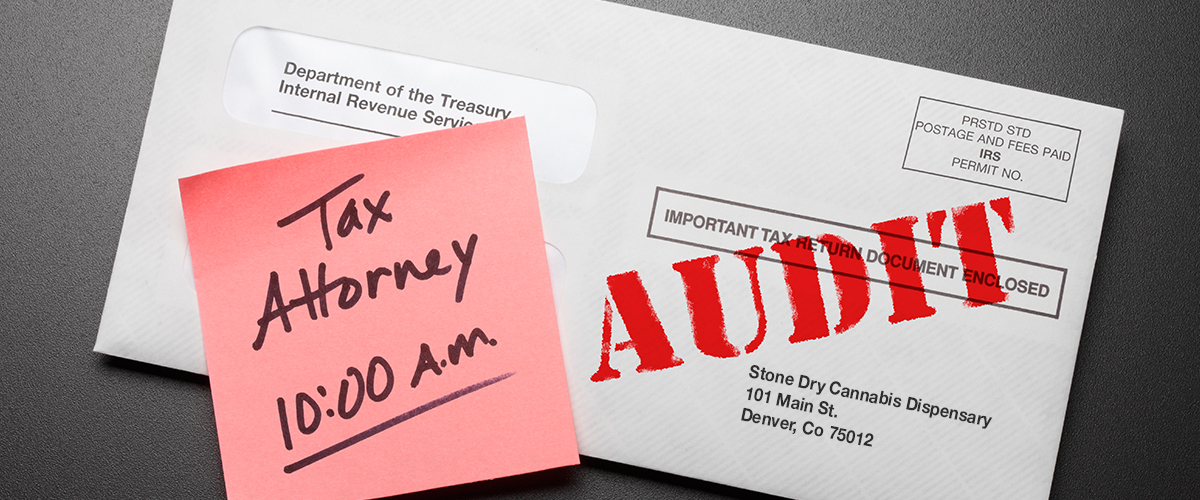

IRS Targeting Cannabis Businesses With “280E Audits”

IRS Targeting Cannabis Businesses With “280E Audits” We previously reported in our blog that the Trump Administration organized a committee of federal agencies from across the government to combat public support for marijuana and cast state legalization measures in a...

California Cannabis Tax Relief Is Here!

California Cannabis Tax Relief Is Here! California Governor Gavin Newsom signed a bill into law that will approve cannabis companies for tax deductions that have otherwise been denied them under IRC Section 280E. This law give legal cannabis businesses a tax break to...

Why Taxpayers Involved In Offshore Accounts, Crypto-Currency Or Cannabis Should Be Filing An Extension For Their 2018 Income Tax Returns.

Why Taxpayers Involved In Offshore Accounts, Crypto-Currency Or Cannabis Should Be Filing An Extension For Their 2018 Income Tax Returns. If you did not report your offshore accounts, crypto currency income or cannabis income earned before 2018, you should hold off on...

Why Is Taxation Related To Cannabis Businesses So Complicated?

Why Is Taxation Related To Cannabis Businesses So Complicated? Beware 2019 Could Be A Banner Year For IRS Audits Of Cannabis Businesses. We previously reported in our blog that the Trump Administration organized a committee of federal agencies from across the...

Top Tips When Selling Your Cannabis Business

Top Tips When Selling Your Cannabis Business It’s a big reward to get a lucrative offer when some big company wants to buy your cannabis business but it is important that you consider any offer carefully to make sure you are getting what you bargained for. Consider...

Attention Cannabis Businesses – Be Prepared To Prove Your Deductions To The IRS

Attention Cannabis Businesses - Be Prepared To Prove Your Deductions To The IRS Generally, businesses can deduct ordinary and necessary business expenses under I.R.C. §162. This includes wages, rent, supplies, etc. However, in 1982 Congress added I.R.C. §280E. Under...

Cannabis Businesses Getting Ready To Prepare Your 2018 Tax Returns – Don’t Miss Out On These Tax Benefits!

Cannabis Businesses Getting Ready To Prepare Your 2018 Tax Returns – Don’t Miss Out On These Tax Benefits! The Tax Cuts And Jobs Act Of 2017 (“TCJA”) was signed into law by President Trump on December 22, 2017. It has been a good 30 years since the last time the...

Portland Cannabis Business Owner Receives Federal Prison Sentence For Tax Crimes

Portland Cannabis Business Owner Receives Federal Prison Sentence For Tax Crimes The U.S. Attorney’s Office for the District Of Oregon announced on September 17, 2018 in a press release that Matthew Price, age 32, of Portland, was sentenced to seven months in federal...