Cannabis Businesses Deemed “Essential” in California Under COVID-19 Orders

In an effort to “flatten the curve” of this coronavirus pandemic,...

Coronavirus Aid, Relief and Economic Security Act – Part 2: Businesses

On March 27, 2020 President Trump signed the $2...

Coronavirus Aid, Relief and Economic Security Act – Part 1: Individuals

On March 27, 2020 President Trump signed the $2...

IRS Responding To COVID-19 With “The IRS People First Initiative” For Examination And Collection Tax Relief

IRS Coronavirus Tax Relief

The...

California Cannabis Businesses Coping With COVID-19

State & local governments are taking unprecedented measures to stop dine-in restaurant service, close...

IRS Coronavirus Tax Relief

The IRS has established a special section focused on steps to help taxpayers, businesses and others...

How Are Cannabis Businesses Coping With COVID-19?

State & local governments are taking unprecedented measures to stop dine-in restaurant service,...

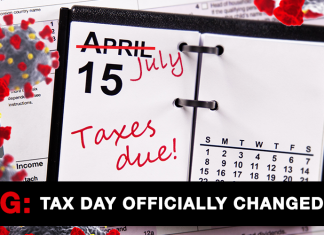

Federal & State Tax Agencies Responding To COVID-19 With Tax Relief – IRS And Treasury Department Issues Initial Guidance

IRS...

It just got more expensive to settle your tax debt with the IRS. The Application Fee for Offers In...

The IRS announced on March 6, 2020 that victims of tornadoes and severe storms in parts of Tennessee, including...