Historic ruling that can impact challenging large penalties in the future. In recent years the IRS has made the Report of Foreign Bank and Financial Accounts (FBAR) penalty enforcement a top priority and this is alarming the taxpayers worldwide. Even during every...

Featured

Getting Ready For The 2022 Tax Filing Season

This year taxpayers get at least 3 extra days to file! On January 10, 2022, the Internal Revenue Service (IRS) announced that it will process 2022 tax returns beginning January 24, 2022 (last year the opening date was February 12, 2021). The IRS states that the...

IRS Examinations Of Cannabis Businesses Expected To Rise In 2022 – Are You Ready For An I.R.C. § 280E IRS Tax Audit?

IRS Examinations Of Cannabis Businesses Expected To Rise In 2022 – Are You Ready For An I.R.C. § 280E IRS Tax Audit? While the sale of cannabis is legal in California as well as in a growing number of states, cannabis remains a Schedule 1 narcotic under Federal law,...

IRS Criminal Investigation Division Releases Its Top Cases Of 2021

On January 3, 2022 the Internal Revenue Service Criminal Investigation (IRS-CI) began listing he top 10 cases for calendar year 2021 on its Twitter account which are considered to me the agency’s most prominent and high-profile investigations of 2021. IRS-CI is the...

2021 Tax Filing Season – What High Income Taxpayers Should Know About Filing Late Tax Returns

Every year, about 9 million taxpayers miss tax deadline or fail to file their tax returns according to data from the Internal Revenue Service. How To Handle Late Tax Returns? The Treasury Inspector General for Tax Administration on May 29, 2020 issued a report finding...

New For 2022: Tax Rule Affecting People Who Use Venmo, Paypal Or Other Payment Apps.

Why Tax Planning Is More Important If You Earn Income From The Gig Economy. From renting spare rooms and vacation homes to car rides or using a bike…name a service or a craft & handmade item marketplace and it’s probably available through the gig economy which is...

California Putting Pressure On Delinquent Taxpayers To Pay

Don’t think that you can avoid California tax enforcement action just because we are in a pandemic. California is unique in the structure of its tax system. Most States operate under a single tax agency. The Federal government uses a single tax agency called the IRS....

Getting Ready For Tax Season 2022 – What You Need To Know About Reporting Economic Impact Payments

The third round of the Recovery Rebate Credit is authorized by the American Rescue Plan Act (ARPA) of 2021 which expanded the Child Tax Credit (CTC) for tax year 2021 only. Generally, this credit will increase the amount of your tax refund or decrease the amount of...

California Raising Cannabis Taxes In 2022

California Raising Cannabis Taxes In 2022 The California Department Of Tax And Fee Administration (CDTFA) which oversees the reporting and collection of taxes for the California cannabis industry under Emergency Regulation 3700 established a new category and tax rate...

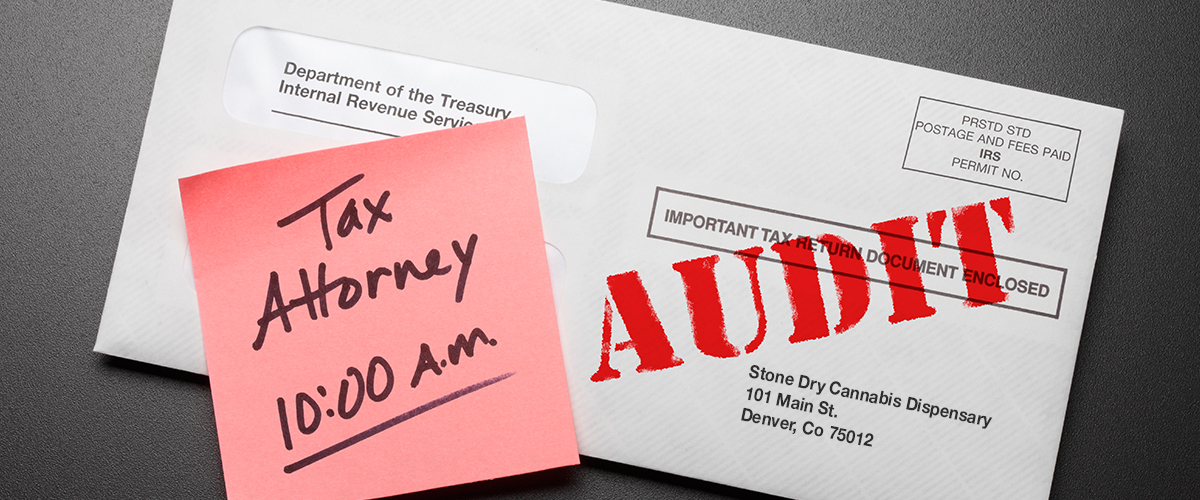

When Facing An IRS Tax Audit, How Do Marijuana Businesses Explain To IRS A Cash Stash Accumulated From The Past?

When Facing An IRS Tax Audit, How Do Marijuana Businesses Explain To IRS A Cash Stash Accumulated From The Past? With the proliferation of licensed cannabis businesses sprouting in the State Of California and a growing number of States, a lot of cannabis business will...