Rescheduling Of Cannabis Opens Relief For Cannabis Businesses To Settle IRS Tax Debt Through An Offer In Compromise. President Trump’s December 18, 2025 Executive Order to remove cannabis from a Schedule I classification to a Schedule III classification President...

Featured

Rescheduling Of Cannabis Opens Relief For Cannabis Businesses To Settle IRS Tax Debt Through An Offer In Compromise.

President Trump’s execution on December 18, 2025 of an Executive Order Increasing Medical Marijuana and Cannabidoil Research to remove cannabis from a Schedule I classification to a Schedule III classification should result in cannabis businesses with IRS debt to...

President Trump Orders Cannabis Rescheduling To Be Expedited

The prime benefits of reclassifying cannabis from a Schedule I substance to a Schedule III substance is that the Federal government would recognize medical benefits of cannabis, make IRC Section 280E inapplicable to licensed cannabis operators. On December 18, 2025,...

U.S. Tax Court Denies Cannabis Dispensary To Pursue An Offer In Compromise

An Offer In Compromise allows you to settle your tax debt for less than the full amount you owe. It may be a legitimate option if you can't pay your full tax liability or doing so creates a financial hardship. The IRS will consider your unique set of facts and...

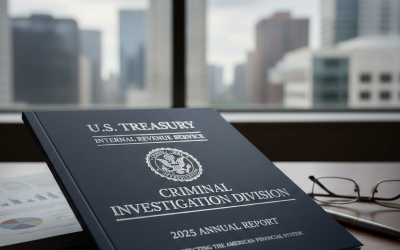

IRS Criminal Investigation Division Releases Its 2025 Annual Report

The IRS released the Criminal Investigation Division’s (CI) annual report, highlighting significant successes and criminal enforcement actions taken in fiscal year ending September 30, 2025. The IRS noted that a key achievement was the identification of over $10.5...

Using Family Limited Partnerships In Estate Planning

What can we learn from Sam Walton, Walmart’s founder? Long before the Walmart retail business took off, Sam was gifting interests in his business to his children. As Sam explained in his autobiography Made in America, “giving assets away early prevents future tax...

How may the 2025 government shutdown impact IRS preparation for the 2026 filing season?

Former IRS Commissioner Danny Werfel expressed concern over events since his resignation in January 2025 that he believes will have an adverse impact on IRS’ ability to handle operations for the 2026 filing season. Those events comprise of - The 2025 government...

White House Proposes Americans to Report, Pay Taxes on Foreign Crypto Accounts

In the summer of 2025 the White House proposed that Congress should consider drafting legislation that would force U.S. residents and companies to report foreign digital asset accounts on their taxes. A digital asset is a digital representation of value that is...

Bakersfield Tax Return Preparer Sentenced for Role in $25 Million Fraud Scheme

The U.S. Justice Department (“DOJ”) announced on November 17, 2025 that Victor Cruz, age 41, of Bakersfield, California was sentenced to 18 months in prison for participating in a scheme to submit fraudulent individual federal income tax returns that claimed...

IRS Announces Penalty Relief for Tax Year 2025 for Information Reporting on Tips & Overtime under the One Big Beautiful Bill Tax Act

On July 4, 2025 President Donald J. Trump signed into law H.R.1 - One Big Beautiful Bill Act (“OBBBA”). OBBBA contains hundreds of provisions including permanently extending the individual tax rates Trump signed into law in 2017, which were originally set to expire...