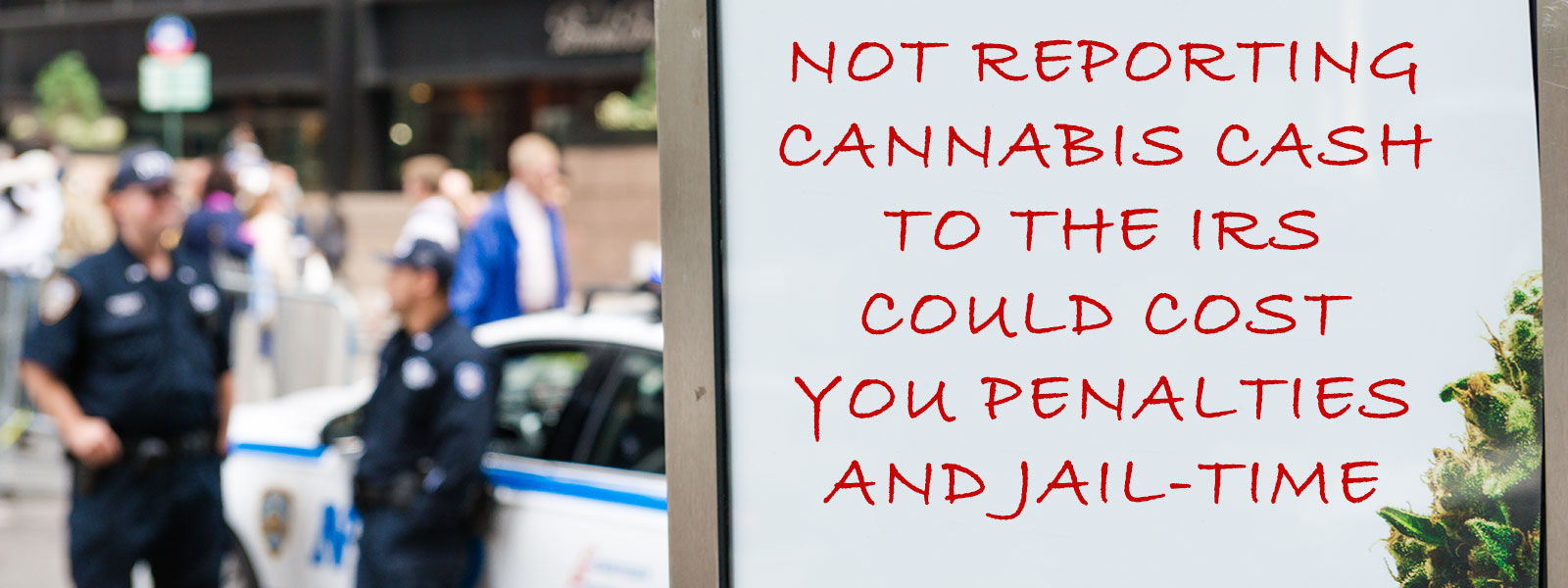

Attention Cannabis Businesses Dealing With Cash – Beware Of IRS Required Filings That If Not Followed Could Lead To Penalties And Jail-time

While there is no law making it illegal to transact business with cash, the IRS has an interest in requiring parties to report cash transactions to deter those who evade taxes, profit from the drug trade and engage in terrorist financing and other criminal activities. The government can often trace money from these illegal activities through the payments reported on this and other cash reporting forms. This is particularly true as more and more states are allowing the sale of cannabis at the medical and/or recreational level.

Bank Secrecy Act – Reporting Of Cash Payments.

Since 1970, the Bank Secrecy Act (“BSA”) requires financial institutions in the United States to assist U.S. government agencies to detect and prevent money laundering. Specifically, the BSA requires financial institutions to keep records of cash purchases of negotiable instruments, and file reports of cash purchases of these negotiable instruments of more than $10,000 (daily aggregate amount), and to report suspicious activity that might signify money laundering, tax evasion, or other criminal activities. The BSA requires any business receiving one or more related cash payments totaling more than $10,000 to file IRS Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business.

The minimum penalty for failing to file EACH Form 8300 is $25,000 if the failure is due to an intentional or willful disregard of the cash reporting requirements. Penalties may also be imposed for causing, or attempting to cause, a trade or business to fail to file a required report; for causing, or attempting to cause, a trade or business to file a required report containing a material omission or misstatement of fact; or for structuring, or attempting to structure, transactions to avoid the reporting requirements. These violations may also be subject to criminal prosecution which, upon conviction, may result in imprisonment of up to 5 years or fines of up to $250,000 for individuals and $500,000 for corporations or both.

Electronic Filing Of Form 8300, Report of Cash Payments Over $10,000.

Although businesses have the option of filing Form 8300, Report of Cash Payments Over $10,000, on paper, there is the option to e-filing this form especially since the deadline to file the form is 15 days after a reportable cash transaction occurs.Businesses that file Form 8300 electronically get free, automatic acknowledgment of receipt when they file and since the reporting involves no IRS personnel interaction, it could arguably lower scrutiny by the IRS. To file Form 8300 electronically, a business must first set up an account with the Financial Crimes Enforcement Network’s BSA E-Filing System.

For more information about the reporting requirement, you can check out the fact sheet put out by IRS at FS-2019-1 which among other things includes reporting scenarios for specific businesses, such as automobile dealerships, taxi companies, landlords, colleges and universities, homebuilders and bail-bonding agents.

Financial Crimes Enforcement Network (“FinCEN”).

FinCEN is a bureau of the U.S. Department of the Treasury. The Director of FinCEN is appointed by the Secretary of the Treasury and reports to the Treasury Under-Secretary for Terrorism and Financial Intelligence. FinCEN’s mission is to safeguard the financial system from illicit use and combat money laundering and promote national security through the collection, analysis, and dissemination of financial intelligence and strategic use of financial authorities.

FinCEN carries out its mission by receiving and maintaining financial transactions data; analyzing and disseminating that data for law enforcement purposes; and building global cooperation with counterpart organizations in other countries and with international bodies.

FinCEN exercises regulatory functions primarily under the Currency and Financial Transactions Reporting Act of 1970, as amended by Title III of the USA PATRIOT Act of 2001. Under this authority the Secretary of the Treasury is to issue regulations requiring banks and other financial institutions to take a number of precautions against financial crime, including the establishment of AML programs and the filing of reports that have been determined to have a high degree of usefulness in criminal, tax, and regulatory investigations and proceedings, and certain intelligence and counter-terrorism matters. This authority has been delegated to FinCEN.

The basic concept underlying FinCEN’s core activities is “follow the money.” As FinCEN believes that the primary motive of criminals is financial gain, and they leave financial trails as they try to launder the proceeds of crimes or attempt to spend their ill-gotten profits. FinCEN shares the information it receives and analyzes with other law enforcement agencies to investigate and hold accountable a broad range of criminals, including perpetrators of fraud, tax evaders, and narcotics traffickers. More recently, the techniques used to follow money trails also have been applied to investigating and disrupting terrorist groups, which often depend on financial and other support networks.

What Should You Do?

The IRS scrutinizes in any cash-based business the amount of gross receipts to report and it is harder to prove to the IRS expenses paid in cash. However, this should not undermine the importance that the proper facilities and procedures be set up to maintain an adequate system of books and records which even in an environment of running a business without a traditional bank is possible.

Start your cannabis business on the right track. Protect yourself and your investment by engaging a cannabis tax attorney at the Law Offices Of Jeffrey B. Kahn, P.C. located in Orange County (Irvine), the Inland Empire (Ontario and Palm Springs) and other California locations. We can come up with tax solutions and strategies and protect you and your business and to maximize your net profits. Also, if you are involved in crypto currency, check out what a bitcoin tax attorney can do for you.